How do you get consumers to buy electric vehicles?

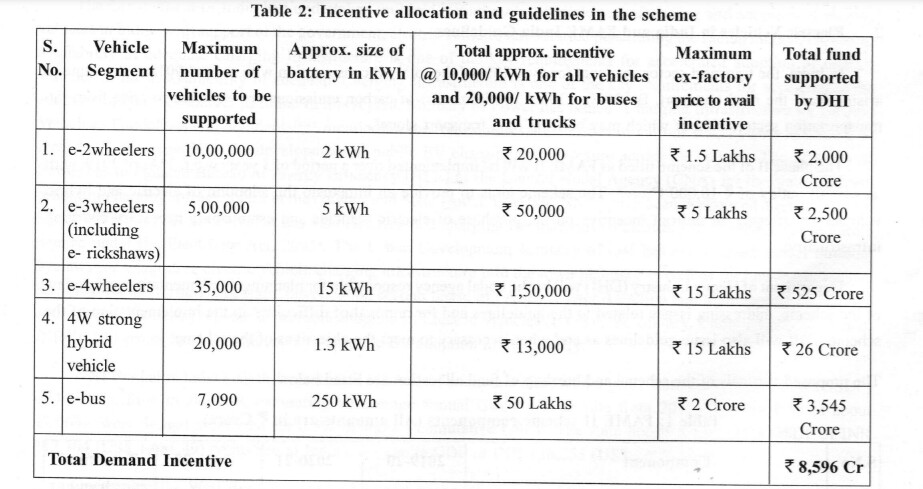

On the demand side, the Government has offered direct incentives. For example, through the 2019 Faster Adoption and Manufacturing of Hybrid and Electric vehicles (FAME-II) scheme, Rs 15,000 per kWh of battery capacity (to a maximum of 40 per cent of the vehicle cost) is offered for a two-wheeler (scooter or bike). For electric four-wheelers, it’s a direct incentive of Rs 10,000 per kWh of battery capacity up to Rs 1.5 lakh.

(Image above courtesy PradeepGaurs/Shutterstock.com)

Going further, the Centre also offers a low GST rate of 5% on all EVs, which is a much lower tax burden than that of petrol and diesel cars, and first-time individual buyers who avail of a loan can also get tax benefits of up to Rs 1.5 lakh under Section 80EEB of the Income Tax Act. In August 2021, the Ministry of Road Transport and Highways issued a notification exempting electric vehicles from paying fees for the issue or renewal of registration certificates.

These EV subsidies/incentives are over and above those provided by respective State governments and applicable across the country.

Delhi: For two-wheelers, consumers can avail a subsidy of Rs 5,000 per kWh of battery capacity up to Rs 30,000 in addition to exemption on registration and road tax. If consumers want to buy a four-wheeler, they can avail a subsidy of Rs 10,000 per kWh of battery capacity up to Rs 1.5 lakh, in addition to exemptions on registration and road tax. Having said that, only the first 1,000 electric cars registered in the state can avail of these benefits.

Click here to see the EV models eligible for electric vehicle subsidy in Delhi.

Gujarat: For two-wheelers, consumers can avail a subsidy of Rs 10,000 per kWh of battery capacity up to Rs 20,000 for the first 1.1 lakh electric two-wheelers. Consumers can enjoy an exemption on road tax and registration as well. Meanwhile, for cars, consumers can avail a subsidy of Rs Rs 10,000 per kWh of battery capacity up to Rs 1.5 lakh for the first 10,000 buyers. This is in addition to exemptions on registration and road tax.

Maharashtra: All electric vehicles in the state are exempt from road tax and registration charges. In this state, the first 1 lakh electric two-wheeler buyers are eligible for an incentive of Rs 5,000 per kWh of battery capacity, which is capped at Rs 10,000. The state is also offering an early bird incentive to buyers of up to Rs 15,000 (with a 3 kWh battery) if the two-wheeler is bought before 31 December 2021. There’s also a scrappage incentive of Rs 7,000 on offer.

For four-wheelers, Maharashtra offers the same as Delhi and Gujarat, but for those who buy before 31 December 2021, there’s an additional incentive of up to Rs 1 lakh. The government has made it mandatory for all upcoming property projects to have dedicated, EV-ready parking spaces in residential apartments, institutional/commercial complexes and government offices.

Meghalaya: Going by the state-mandated electric vehicle policy issued earlier this year, which is slated to remain in operation or valid for five years from the date of notification, consumers can avail of similar subsidies/incentives like the ones mentioned above.

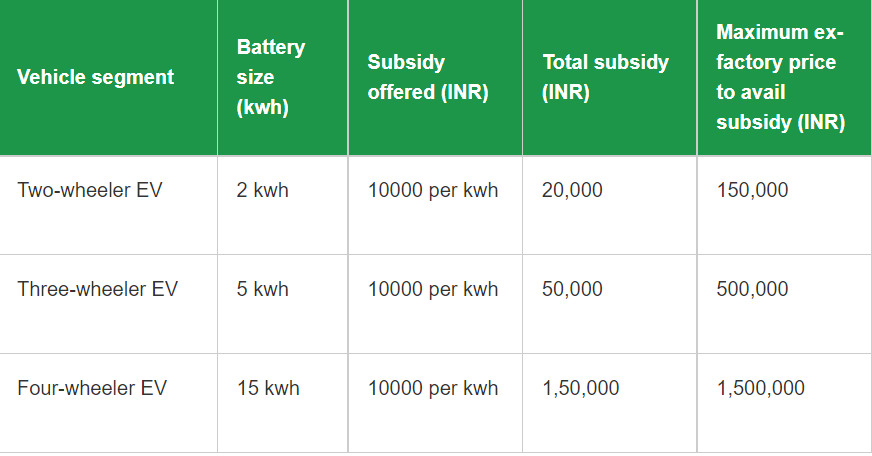

For the first 3,500 two-wheelers bought and registered in the state, the government is offering a subsidy of Rs 10,000 per kWh of battery capacity. The maximum ex-factory price to avail incentive is Rs 1.5 lakhs for electric two-wheeler vehicles. Meanwhile, for the first 2,500 four-wheelers, it’s offering an incentive of Rs 4,000 per kWh of battery capacity. The maximum ex-factory price to avail incentive is Rs 15 lakhs for electric four-wheeler vehicles. Also, both two and four-wheelers are exempted from road tax and registration.

Assam: According to this explainer, “The state government of Assam will support the deployment of the first 200,000 EVs [100,000 two-wheelers, 75,000 three-wheelers and 25,000 four-wheelers) either under commercial use or individual use over the next five years.”

Going further, there is a waiver on road tax and registration of EVs for the next five years and zero parking charges till 2026 for EV owners.

West Bengal: The government has waived road tax and registration fees.

Rajasthan: All EV two-wheelers sold and registered in the state between 1 April 2021 and 31 March 2022 will qualify for SGST reimbursement. A consumer will receive the SGST paid to the seller of the vehicle, and this amount will be transferred by the district transport officer.

“Electric scooters and motorcycles with a battery capacity of up to 2 kWh will be eligible for a subsidy of Rs 5,000. Models with a battery capacity of 2 to 4 kWh will be eligible for a Rs 7,000 incentive…What will come as a surprise is that the policy does not cover electric cars and SUVs, and steers clear of offering any large incentives to buyers of such vehicles. The one-time subsidy is only available to buyers of two and three-wheelers,” notes this First Post explainer.

Telangana, Goa and Odisha: The state government [Telangana] exempts road tax and registration fees for the first 2 lakh EV two-wheelers bought and registered within the state. A similar exemption is being offered for the first 5,000 electric four-wheelers bought and registered within the state.

Goa, meanwhile, has announced registration fees and road tax waivers for electric two-wheelers.

Similarly, Odisha has announced a 100% exemption of motor vehicle tax and registration fees as well. This exemption is applicable till 2025, according to the Odisha Motor Vehicles Taxation Act. Going forward, 100% interest-free loans would be made available to State government employees for the purchase of electric vehicles.

Karnataka, Andhra Pradesh: Residents of Karnataka are eligible for a subsidy under the Central government’s FAME-II scheme, but it does not offer the kind of subsidies/incentives that other states like Delhi or Maharashtra offer. Their efforts at making EVs more affordable hinges on offering subsidies/incentives and concessions on the supply side.

However, like some other states, it also offers full exemption from road tax and registration fees for electric vehicles. Similarly, in Andhra Pradesh, EVs are exempt from registration fees and road taxes.

Despite these efforts, more needs to be done. According to Minister of State for Heavy Industries Krishan Pal Gurjar’s statement in Parliament on 9 August 2021, only 13 states (Andhra Pradesh, Delhi, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, Meghalaya, Gujarat, West Bengal) have approved/notified dedicated EV policies to promote adoption of electric vehicles.

More states must get actively involved to bolster the adoption of EVs. And as Car Dekho, a prominent car search venture, notes in this explainer, “there are limits on the number of beneficiaries under each scheme and not all electric cars sold in India are eligible for subsidies.” It goes on to add, “heavy taxes on EVs and hybrids imported by carmakers as completely built units (CBUs) has further narrowed options for those wanting an affordable EV.”

(Edited by Vinayak Hegde)

No comments:

Post a Comment